While Drumheller Town Council was able the hold the line on spending in their 2020 operating budget, increased requisitions, and a lower assessment value saw the Mill Rate increase slightly.

Council passed the Mill Rate Bylaw at its Monday, April 19 meeting. The combined residential Mill Rate, which includes school and Drumheller and District Senior Foundation, was set at 11.85663, up from the 2020 Mill Rate of 11. 56901. The combined non-residential Mill Rate went from 17.81293 to 18.73769.

This means for a residential property valued at $250,000, taxes would go from $2,892.25 to $2,964.16. This would be if the property assessment maintained the same value. However, assessment values have dropped over the last year.

Of the $19 million drop in taxable residential assessment values, $3.6 million relate to properties that became exempt as they were bought up as part of the flood mitigation program. The remaining $15.4 million decrease is related to changes in market value. Non-residential properties saw an average drop of 2.3 per cent.

“What that means for municipalities is even if tax requisitions stay the same, Mill Rates will go up. But that doesn’t necessarily mean taxes will also go up. It depends on the properties,” explains Director of Corporate Services Mauricio Reyes. “On some properties, taxes can increase, for some, it will actually decrease, and some will see the same amount as in prior years. So it is really important to mention why, and it’s because of the assessment.”

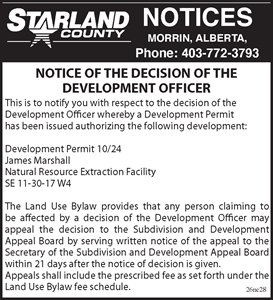

The requisition from the Alberta School Foundation increased in 2021, and the requisition from the Christ the Redeemer Catholic School Division decreased. The Drumheller and District Senior Foundation requisition increased, however as Councillor Tom Zariski noted this is because the requisition is based on assessments of all the partner municipalities of the Foundation, including Delia, Morrin, and Starland County.

While tax rates cannot be appealed, a resident can appeal their assessment. For a property owner to appeal, the first step is to compare your assessment to other similar properties. This can be done at town hall. If you are not satisfied, you can file a written appeal to the Assessment Review Board Clerk at the Town of Drumheller Office. This appeal must be done within 60 days of the Notice of Assessment date. There is a fee to appeal, which will be refunded if the board rules in your favour or the appeal is withdrawn before it being heard by the board. More information is available at www.drumheller.ca or by calling 403-823-1314.