Starland County has reached a milestone in achieving no long-term debt.

CAO Ross Rawlusyk said they have retired the last of their long-term debt from the Alberta Capital Authority. As it stands, the county has no outstanding long-term borrowing.

“I think it is an achievement to eliminate the long term debt and the burden of having to pay any interest. From my standpoint as an administrator, I think it is good news,” said Rawlusyk.

He said in 2010 they still had about $276,000 outstanding long-term debt and paid more than $6,000 in interest.

Because of this achievement, it means Starland's borrowing capacity is much higher. The county’s debt capacity sits at over $18 million.

“While we have a lot of debt capacity, it feels good to know we don’t need to use it,” said Rawlusyk.

“To me there are two components. It allows us to reinvest anything we would have been contributing towards debt payment or interest costs. It gives you more flexibility. It creates a stability too, because you don’t have to raise sufficient funds to budget in long-term debt payments.”

Another plus, according to Rawlusyk, is being able to demonstrate to companies looking for a place to do business that the county’s tax system is sustainable and the municipality has a long range plan.

He says he has taken a look at municipal profiles from neighbouring communities including the Town of Drumheller on the Municipal Affairs website, which uses 2009 statistics. Within the region there is about $34 million in long-term debt. The average debt per capita is over $1,000. This was before funds were borrowed for the Badands Community Facility.

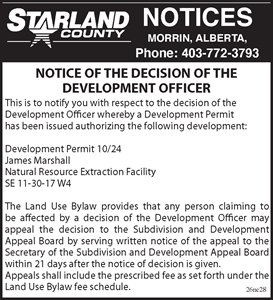

The Village of Morrin is also long-term debt free, according to Rawlusyk.

“Council has a good long range plan and it helps us to pick our priorities and pick projects that we can get done if possible using grants,” he said.

He points out that many of the surrounding municipalities debts have to do with municipal water. Starland has been able to utilize grants to make their water improvements, which have a value of about $20 million.

The county is also approaching completion of a major renovation of its offices, which has also drawn upon grant programs.

One focus they would like to work on is reducing short-term or operating debt. While the municipality collects its taxes on September 30, it has commitments throughout the year including quarterly Alberta School Foundation Fund payments.

“By the time we get our first tax dollar in for the year, we have already made $1.5 million in school payments. What that does is take away from our operating cash, so then when we get into the end of August we are becoming operating cash poor.”

He says they are working on a resolution that would see them not having to make school payments before they collect the revenue.

“That would address any short term borrowing issues,” said Rawlusyk.

The county's next goal is to build up its reserves.

“What we are trying to do is instead of borrowing we are trying to save money to buy things we might need,” said Rawlusyk.