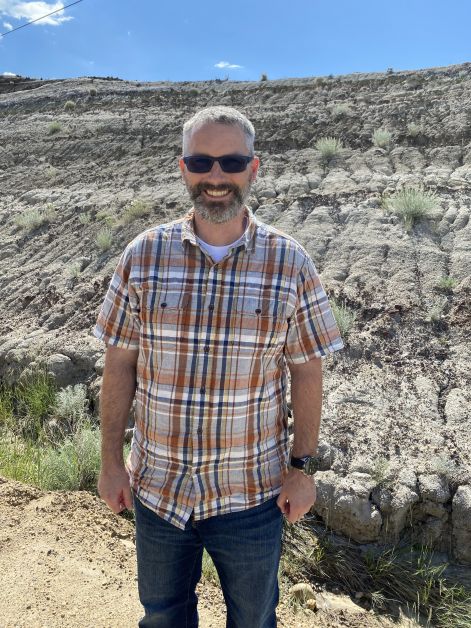

Jared Brounstein has been appointed Director of Infrastructure Services at the Town of Drumheller.

For the last five years, Brounstein has worked in Osoyoos, BC, but also lived in various municipalities across Western Canada, including Clearwater, BC, Chilliwack, BC, and St. Albert.

“My background is in water and wastewater, but I also have experience in emergency management (I dealt with two large wildfires when in Osoyoos), project management, capital projects/programs, highway infrastructure, and civil engineering. I am currently completing my degree in technology management,” said Brounstein.

He has worked in both the public and private sectors, which has exposed him to various jurisdictions of different sizes. He intends to use that knowledge and experience in Drumheller to help council achieve its objectives for the Valley.

“So far, I find the valley very charming. I can’t wait to move my family out here to enjoy the events and activities the community offers,” said Brounstein. “It’s been very refreshing; people are so friendly! They say hi to you on the street. It’s been very welcoming. There seems to be so much to discover here.”